When it comes to real estate transactions, timing is not everything. Nonetheless, it is a major consideration. Considerations such as your budget and how long you want to stay in the property might also play a role. The timing of a house purchase is also affected by market and economic conditions. Spring and summer often see a rise in available homes for sale, while winter tends to be a slower time for the real estate market. Do prices change from place to place, and how much of an impact do these differences have on your shopping habits? In addition, the COVID-19 shutdowns this year have distorted long-term trends.

In the spring of last year, when you would have expected a flurry of business, the outbreak kept some buyers and sellers on more than just the sidelines. In general, we witnessed a reduction of 18 to 20% in house sales in May 2020, which is generally a busy time of year. The dip corresponded with a fall in the number of residences for sale. Due to the unstable economic climate, mortgages are become harder to get.

How Does a House Purchasing Work?

The kind of loan chosen by a house buyer influences the long-term cost of the property. There are different options available for mortgage loans; however, the greatest long-term choice for homeowners is a mortgage rate that is set for a period of thirty years. Compared to a 15-year loan (which is more typical for refinancing), the interest rate on a 30-year fixed loan will be higher; however, there will be no surprises in the form of rate increases or decreases in the future. Other types of mortgage loans include those with a prime interest rate, those with a lower credit score, and those with an "Alt-A" rating.

In order to be eligible for a prime residential mortgage, the Federal Reserve requires a borrower to not only have an excellent credit score (often 740 or above), but also to be virtually debt-free. This sort of mortgage also requires a substantial down payment, ranging from 10% to 20%. The low interest rate that is typical for this kind of loan is a direct result of the low risk that the lender perceives the borrower to present.

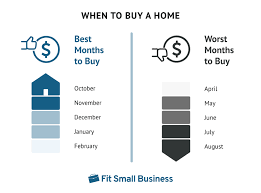

What Is the Most Affordable Month to Buy a Home?

Typically, house prices drop throughout the winter months. The median home price in January was $249,000, the lowest it has been all year. With a $9,000 drop between December 2019 and January 2020, prices have leveled out after a year of growth. If getting the lowest possible price at the moment of purchase is your top priority, bundle up with some wool gloves. Consider the fact that the real estate market tends to go into hibernation during the winter months, with fewer homes on the market during the busiest time of the year. Over 250,000 houses were taken off the market between November and December of last year.

Which Month Sees the Greatest Number of Home Listings?

The majority of homes are listed for sale in the spring. From March to April of this year, the nationwide number of houses for sale increased by 160,000, the fastest growth rate of the year. As the year progressed, the total rose until June, when there were 1.92 million homes for sale. For this reason, spring is the best season to buy a jacuzzi as well as an outdoor fire pit.

On the downside, spring is also the busiest season for house hunting, so competition and prices will most likely be at their peak. Last year, property prices increased by $11,000 from April to May, peaking in June at $285,000. However, if you have the financial means, it is frequently worthwhile to browse when there are so many houses on the market to pick from.

Is it a Good Time to Buy a House During a Recession?

Buying a house during a recession may be a good or bad idea depending on the specifics of the situation. Your ability to pay will decide the amount. There is a halt to economic growth during a recession as consumers and businesses reduce their spending. The economy declines for about six months instead of improving gradually, and the negative effects of this slump may last for much longer.

Currently is not the time to buy a property if you're concerned about your employment or money due to the recession. However, if you are financially stable and savvy, purchasing a property during a downturn may be a terrific opportunity to save money.

Conclusion

As with any market transaction, getting the best offer on a property depends heavily on the laws of supply and demand. So that you may choose from available resources (supply) without having to compete with the rest of the market, it's ideal if (demand). Finding this sweet spot will save you from having to constantly monitor the market for home opportunities.