Introduction

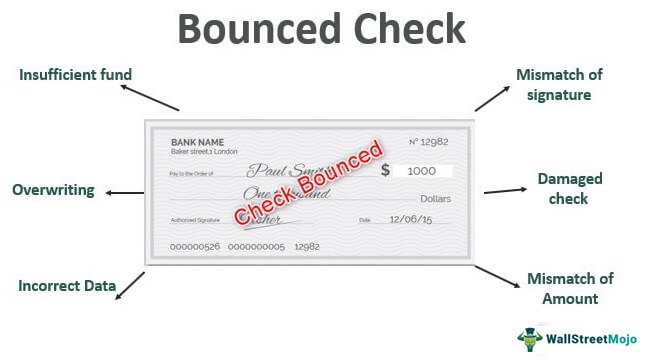

People often write bounced checks because they are unaware that their account balances are insufficient. Some people use overdraft protection or a linked line of credit to their checking account so that they never have to worry about their checks being returned as unpaid. Fees, limitations on future check writing, and lower credit scores are all possible outcomes of a failed check. If you have a history of failed checks, you may be blocked from using checks for payment with local businesses. When determining the legitimacy of a customer's check, many businesses rely on TeleCheck, a check verification service. If the check you just presented for payment has a history of being returned unpaid, the merchant will likely refuse to accept it and request another form of payment.

What Occurs If Someone Writes A Check Without Sufficient Funds In Their Account?

A check that is returned unpaid will result in consequences on your end. The following are a few examples of circumstances to watch out for:

Penalties And Bank Fees

The first thing that will happen if your check bounces are that your bank will likely charge you a fee. The average overdraft fee in 2020 was $33.47, though the exact cost will depend on your financial institution. It would help if you were normally prepared to spend $25 or more. Sadly, the total quickly mounts up.

Unpaid Invoices

When you write a faulty check, the intended recipient won't receive the funds. Let's say you want to reward a local business owner for their excellent service by giving them a bad check. Your check has bounced. Therefore the company won't get paid when they try to cash it. The business will still be owed the money, and you'll have to cover the gap until you have the means to do so.

Difficulties with ChexSystems

ChexSystems is a consumer reporting business that financial institutions use to vet potential new clients for reliability. If you apply for a bank account, the institution will likely look at your ChexSystems report to understand the potential risks of opening an account. Bounced checks will reflect poorly on your financial management skills and appear on your ChexSystems report. Because of this, you may have trouble opening bank accounts in the future.

Inactive Bank Accounts

Writing bad checks regularly can cause serious issues with your bank. If you keep writing bad checks, the bank can start to suspect something is up. In such a scenario, the bank has the option to close or freeze your account permanently. Though this is a dire outcome, it is not impossible. Talk to a bank rep if you suspect you are receiving an excessive number of bad checks. If you take the lead, they may be more receptive to collaborating with you.

Why Do People Write Bad Checks?

Insufficient Resources

Insufficient funds to pay the check amount is the most frequent cause of checks bouncing. For example, suppose you need to write a check for $1,500. But your cash on hand is only $1,000. When the payee tries to cash the check, it will bounce since you do not have enough money in your bank account to cover the amount written on the check. Not only will your check bounce, but you'll also be charged a fee for doing so.

Dated Too Long

Another reason a check can be unpaid is if it hasn't been cashed in fewer than six months, a condition known as "stale" or "stale-dated." This means you may need to write a fresh check for the payee to use. Ask your bank how they recommend you handle a stale check.

Methods for Preventing a Check from Being Returned Unpaid

Before writing a check, the issuer must verify sufficient funds in a bank account. Additionally, they need to double-check that they have correctly entered the inputs and the necessary information, as there are several potential causes for checks to bounce. And they should also handle the check appropriately as a damaged check leads to the bouncing of the check and the default by the payment.

Conclusion

When the funds in the account from which a check is drawn are insufficient to cover the amount of the check's payment, the bank from which the check was drawn will not pay the amount. The bank that issued the bad check usually assesses a fee to the check's creator. The organisation that processes the check payment will also incur some additional costs. If a company discovers a customer's check has bounced, it will likely stop extending credit to them and instead demand immediate payment in cash. With an overdraft agreement in place, an issuer can write checks even if there is insufficient money in the account to cover their full face value.