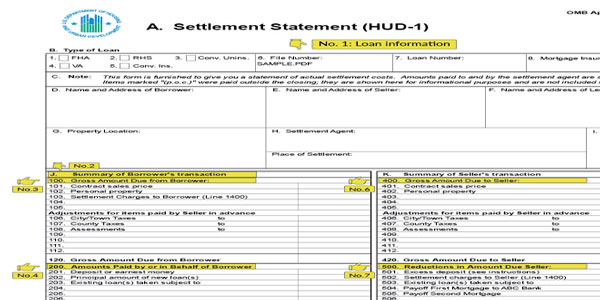

Commonly used in the mortgage industry, the HUD-1 form is also known as a HUD-1 Settlement Statement. This document is used at a consumer credit mortgage closing by the lender or lender's closing agent to itemize all costs and credits to the buyer and seller. Reverse mortgages and mortgage refinancing are two of the most prevalent uses of the HUD-1 form.

The HUD-1 form was phased out and replaced with the Closing Disclosure form on October 3, 2015, although if you applied for a mortgage prior to that date, you would have received a HUD-1. The HUD-1A form may be used in real estate transactions when there is no seller, such as a refinance. Closing Disclosure forms are now provided to borrowers instead of HUD-1 forms for the vast majority of mortgage loans. The borrower is responsible for ensuring there are no mistakes or unexpected costs by reviewing either document before the closure.

How to Read a HUD-1 Form

All of the money you will need to pay to close the deal is on the HUD-1. The form is a federally mandated standard real estate settlement form for use in mortgage refinancing and reverses mortgage transactions. According to federal regulations, a copy of the HUD-1 must be delivered to the borrower at least one day before to settlement; however, figures may be updated or modified up until the parties are sitting at the closing table. The vast majority of purchasers and sellers have their real estate agent, lawyer, or settlement agent check the paperwork before signing. Even if there isn't a loan involved, HUD-1 labels purchasers as "borrowers."

Do Lenders Still Use HUD-1 Settlement Statements?

In the case of reverse mortgages, the HUD-1 settlement statement is still the norm over 62-year-old house sellers who want to cash out their equity love these mortgages. In the three to ten years after a short sale that occurred before 2015, lenders often request copies of prior HUD-1 statements to verify the transaction's closing date.

When Is the HUD-1 Distributed?

Lenders were required to provide borrowers with a copy of the HUD-1 at least one day prior to settlement in accordance with RESPA until October 3, 2015. However, entries might possibly still be flowing in until a few hours before closure. Both parties, with the help of their real estate agent and the settlement agent, often reviewed the statement before signing it. The idea was that the more individuals evaluated it, the more likely problems would be identified.

What Is Information on a HUD-1 Form?

In a peculiar design choice, the HUD-1's back side must be seen first. On the other side, there are two columns: the first lists the buyer's fees, followed by the seller's fees. The borrower must pay a variety of costs associated with getting a mortgage. These costs are detailed on the borrower's list. In addition to the down payment and closing expenses, you may also have to pay for things like owner's and property taxes, lender's title insurance, and prepaid interest on the loan.

In addition to the mortgage payoff and any credits to the buyer under the contract, the seller's list may also include the real estate commission. As a rule, the seller's itemized fees will be cheaper than the buyers. After adding the numbers on the back of the HUD-1 form, the totals are transferred to the front. Both the borrower's cash contribution and the seller's cash receipt are included at the front of the note.

Frequently Asked Questions (FAQs)

What Led to the HUD-1's Replacement?

Before the revision, customers were given a plethora of paperwork that was required by a number of departments at the federal level. The home buyer may get confused as a result, as the paperwork may include conflicting information.

When Can I Expect to Get My Closing Disclosure?

You must get this paperwork three days before your closing, per federal law. Not like the HUD-1, which might be delivered on the day of closing.

Is The HUD-1 Form Shorter Than the Closing Disclosure?

Actually, it's a little longer. The closing disclosure was five pages long, although the HUD-1 only had four pages (including the signing page). Keep in mind that the closing disclosure is a consolidation of many separate forms.

Conclusion

If you get a HUD-1 statement, it's in your best interest to read it thoroughly. To make sure you aren't overpaying for anything and that there aren't any errors that might cost you additional money, it's best to have a real estate attorney go it over for you. The day you get the HUD-1 is crucial to your financial future since you may be repaying this sum for decades.