Subordinated debt differs from senior debt in that it receives payment from a bankrupt company after claims on senior debt have been satisfied. In the case of bankruptcy or dissolution, senior debt is repaid prior to subordinated debt if the firm has both types of debt. After the senior debt is totally paid back, the corporation subsequently pays back the subordinated debt.

Main Concepts:

- Subordinated & senior debt have different insolvency & liquidation priorities.

- Subordinated debt, also called junior debt, comes after senior debt when it comes to getting paid back.

- While senior debt is usually protected and has a greater chance of being repaid, subordinated debt is not typically secured and carries a greater level of risk.

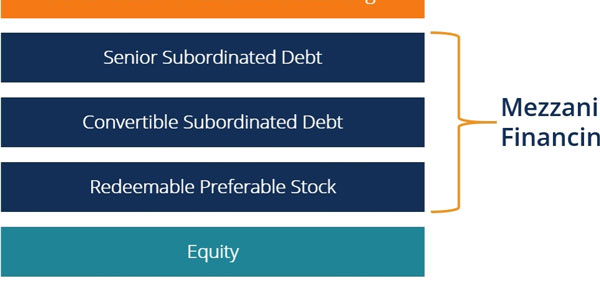

Capital Stack

Before we can figure out what senior and subordinated debt are, we need to look at the capital stack. The capital stack is a ranking system that determines the relative importance of various sources of capital, such as senior debt, subordinated debt, & equity. There are two conclusions that can be drawn from this stack. In the case of financial trouble, the company's senior debt recipients will be paid back in full before any remaining assets are distributed to stockholders. Second, the equity and debt return profiles are counterintuitive to the order of importance. The return profile is steepest for shareholders with an equity investment and steepest for senior loan debtors.

Comprehending the Two Forms of Debt

The risk to the creditor is the underlying difference between the two forms of debt.

Subordinated Debt

When a firm has subordinated debt, there is indeed a chance that it won't be able to repay it if it utilizes any remaining funds from its liquidation to pay off its senior debt holders. A lender is frequently better off holding senior debt than subsidiary debt.

Mezzanine Debt

Mezzanine debt is an illiquid instrument that falls below the level of senior debt. It may come with stock warrants, a bullet payback schedule, and cumulative cash returns. Lenders get the anticipated return on real interest payments plus exposures to the stock upside through equity warrants. Convertible loan stocks and changeable preferred shares are two examples of mezzanine debt that may be turned into equity in full. Some forms of debt securities, such as warranted debt, convertible loan stocks, & changeable preference shares, include equity risks within the debt instrument itself.

Mezzanine Returns

Internal Rate of Return (IRR) goals of 15 percent to 20 percent is common among mezzanine lenders. There are various parts that make up the IRR. Firstly, there is the investor's receipt of interest payments from the corporation. The second component is the interest that has already accumulated and will be paid back together with the principal. These two components form the contractual returns owed to creditors by the firm. In conclusion, warrants' potential for capital appreciation is factored in. Increases a loan investor's internal rate of return by a substantial amount since these warrants are usually worth between 3 and 10 percent of the company's value after an exit.

Senior Debt

Secured debt is usually Senior Debt. Debt that is backed by liens or claims on specific corporate assets is an example of secured debt. In the event of a bankruptcy filing, the firm's senior debt holders have the highest priority for repayment. These may include bondholders or financial institutions that have extended continuous lines of credit to the firm. Following senior debt, holders come, holders of junior debt, preferred shareholders, and finally, ordinary stockholders. These individuals and organizations may get compensation from the proceeds of the sale of collateral pledged as security for a debt.

Distinctive Features

The danger associated with debt is less with senior debt because of its higher priority. Because of this, interest rates on this loan are often lower than those on other types of debt. Subordinated debt, on the other hand, has a greater interest rate because of its lower repayment priority. Senior debt is often funded by banks. Due to their access to low-cost financing sources like deposit and savings accounts, banks take on a reduced risk senior standing in the repayment sequence and can thus choose to accept a reduced rate. Banks, according to the authorities, should have a relatively low-risk lending portfolio.

Any debt that follows or is lower than senior debt is referred to as subordinated debt. But subordinated debt is more important than both preferred and common stock. Mezzanine debt seems to be an illustration of subordinated debt because it is both a loan and an investment. Also, asset-backed securities usually have a feature called "subordinated," which means that some tranches are lower in priority than other tranches. Loans, rents, credit card debt, copyrights, and receivables are all examples of assets that may be pooled together to create asset-backed securities. Tranches are subsets of a security or debt instrument that have been segmented according to risk or shared features in order to appeal to a wider range of investors.

Conclusion

To summarize, there are two categories of corporate debt, which are senior debt & subordinated debt. In the case of a default, senior debt is given precedence over other loans, but subordinated debt is not given such priority. To rephrase, in the event of bankruptcy, senior debt recipients will be paid before holders of subordinated debt. As a further distinction, senior debt often has a reduced interest rate than subordinated debt.