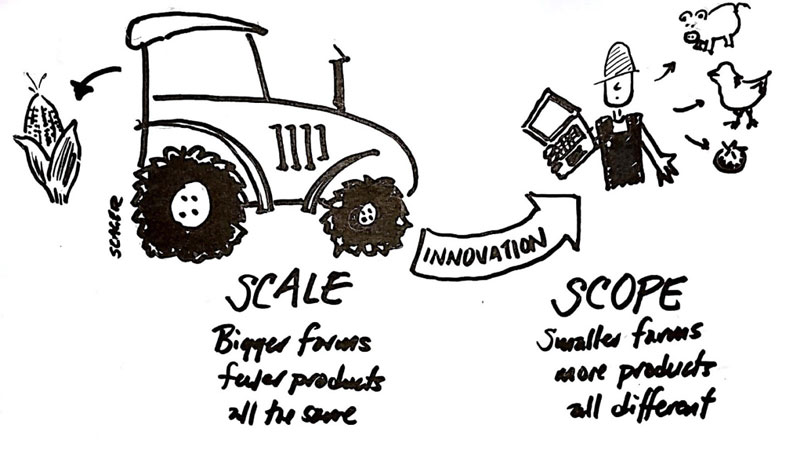

The notion of scope savings and scale economy explains why larger businesses often have lower operating expenses. The aggregate total cost of manufacturing for several items is the central objective of scope-based savings. On the other hand, economies of scale are concerned with the cost-benefit that results from having a more considerable amount of production with one particular commodity.

A business that can reap the benefits of scope reductions has reduced estimated prices as a direct result of the expenses being distributed across a broader range of products. For instance, it is considerably simpler for an existing food company to add new meals to its menu than to launch a whole new chain of restaurants that offers the same kinds of fresh foods. It is possible to advertise various dishes during the same period, and the updates or changes may be cooked and served with the same staff and apparatus when there is a positive relationship between production and consumption, advantages of scope function most effectively.

Economies of Scope Vs Economies of Scale

In contrast and to justify the difference between economies of scope and economies of scale, a business that can reap the advantages of scale economies of scale will have higher average costs. This is because fees will reduce as the volume of product that is produced grows. For instance, a corporation may be capable of producing 100 million microchips at a far lower price per unit than 1 million processors if they made 100 million chips instead. The corporation must spend a particular amount of cash on R&'D for every chip and money spent on establishing each facility. When it is completed, there will be a reduction in the funds needed to make other chips. When there are more ongoing expenses, economies of scale function most effectively.

Costs and Benefits: Economies of Scope

According to the concept of an economy's health, the overall average cost of a firm's production should go down if a more excellent range of products is manufactured by that company. Range economies allow a corporation to get a competitive edge when it produces a variety of goods that are complementary to its core capabilities while also concentrating on those skills. The financial system of scope is a term that is sometimes misinterpreted, mainly because, at first appearance, it appears to be in direct opposition to the concepts of economic expertise and scale economies. Consider that it would be cheaper for two goods to access the very same available resources (if that is feasible) rather than for everyone to have their own individual inputs. This is one straightforward approach to considering about economy of scope.

Rail transportation is an excellent example to use when attempting to explain economies of scale. It is more cost-effective to have a single train that can convey people and freight than two trains, one for carrying passengers and the other for carrying freight. In this particular instance, collaborative manufacturing results in a reduction of the overall input costs. In economics, this indicates that the net marginal advantage associated with a single input element rises once product diversification has occurred.

Take, for instance. The firm ABC is the most successful desktop computer manufacturer in the sector. The ABC Company has decided to expand its product offerings and is renovating its manufacturing plant to accommodate the production of a wider variety of electronic devices. These new products will include laptops, tablets, and mobile phones. As a result of the costs associated with running the production facility being distributed among various goods, the overall average total price has decreased. It would be more expensive to manufacture each electronic gadget in a separate building than to use a single production structure to produce various devices.

Instances of economies of scope that occur in the real world include M&'A, that is, Mergers and acquisitions, the discovery of new applications for resource outputs, and situations in which two different producers agree to share identical aspects of production.

Scale-Based Cost Savings

A corporation's cost leadership as a result of the more excellent production of an item or service is called a scale economy. When it comes to a firm's fixed expenses per component, there is an inverse correlation between the number of products and services produced and the total production volume.

Take, for instance, the scenario in which firm ABC, which is in the business of selling computer processors, is thinking of making a large purchase of processors. The company DEF, which manufactures the computer processors, estimates that the cost of one hundred processors will be $10,000. However, if business ABC were to purchase 500 processor architectures, the manufacturer would offer a cost of $37,500 for the transaction. If the firm ABC decides to buy 100 CPUs from the business DEF, the price of each chip will be $100 for ABC. On the other hand, if ABC purchases 500 computers, the cost per unit will be $75.

In the previous illustration, the manufacturer gives the firm ABC the financial benefit of creating more computer processors. This cost advantage results from the fact that the production of processors has a fixed cost that remains the same whether it generates over 100 or maybe 500 processors.

In most cases, the marginal manufacturing cost for every new computing device drops once the operating costs have been covered. This phenomenon is known as "covering the fixed costs." Extra units often result in an increase in profitability due to declining variable costs. It allows businesses to reduce their pricing if necessary, which boosts the items' overall competitiveness in the market. Companies operating in the style of storage facilities package and distribute huge things in bulk in part because they can take advantage of economies of scale.

Even though it may appear helpful to a corporation, there are constraints associated with economies of scale. It is unusual for marginal costs to go down over time consistently. When activities reach a specific size, it may no longer be possible to continue reaping the benefits of huge-scale economies. This compels businesses to either innovate, enhance their levels of capital, or maintain the output level that is currently ideal for them.