The impactful interest rate that a business pays on its obligations, like bonds and loans, is known as the cost of debt. A firm's cost of debt may be discussed in terms of either the pretax cost of debt or the post-tax cost of debt. The fact that interest expenditures are deducted from taxable income creates the primary source of variation in the cost of debt both before and after taxes.

How Does Debt Cost Work?

A firm's capital structure comprises both stock and debt. Debt financing, in the form of bonds or loans, is only one component of a company's capital structure, which also includes equity financing, which is used to support day-to-day operations and future expansion. The cost of debt is a useful metric for determining the total interest rate at which a corporation is borrowing money. The cost of debt is often greater for more risky businesses. Therefore this metric may also provide investors an insight into the firm's risk level relative to others.

Do Businesses Use Pretax or Post-tax Returns to Calculate the Cost of Debt?

Interest rates charged by financial institutions for lending money are the most common way to characterize the cost of debt. This cost definition is helpful for evaluating various sources of loan financing with the goal of identifying the most cost-effective option. Let's say, for the sake of argument, that two banks, offering otherwise comparable company loans, charge four percent and six percent, accordingly, in interest. If one uses a pretax definition of the cost of capital, it becomes apparent that the first loan is the more economical choice due to its lower interest rate.

However, based on the specifics of the calculation, companies often include the cost of borrowed capital after taxes when trying to gain a more realistic picture of the effect that debt has on the budget. Since interest payments on debt are often tax deductible, using debt to finance a business's operations may result in net tax savings. It is most often used in determining a company's weighted average cost of capital (WACC). After factoring in the relative amounts of equity and loan capital, organizations may calculate their overall average cost of capital using the WACC formula. The cost of borrowing is determined by the WACC method, which is:

Cost of debt = R x (1−T)

Why Must A Business Determine Its After-Tax Cost Of Debt?

Regular borrowers of debt need to be assessing their post-tax cost of debt, but not all companies appreciate the value of this knowledge. It's easy to be distracted by the interest rate on a single loan instead of considering the portfolio in general when comparing financing options. However, because most firms have several debt obligations, they will need to spend some extra time calculating their cost of debt. Businesses may get useful information by determining their true loan cost after accounting for tax consequences. The following are examples of this:

Tax savings:

The tax benefits of figuring out a company's after-tax cost of debt are the most beneficial aspect of doing so. An organization may subtract the interest it pays on its debts from its taxable income. Many companies may benefit from a cheaper cost of capital & a smaller tax bill as a result of this.

Rate analysis:

Businesses might benefit from a deeper knowledge of the cost of capital when considering potential new financing options. With this data, organizations may make informed decisions about which loans to combine, refinance, or pay off. This is crucial in the early phases of development before an investor is found.

Investor confidence:

Knowing one's cost of capital is essential for any company seeking to raise cash. One way that investors may get a sense of a company's whole risk profile is by looking at its after-tax cost of debt. Though investors may look at other things, this is a good approach to back up a company's claims. Above and above this, it is prudent for a company to be aware of the proportion of its total spending that is devoted to servicing its debt. The debt ratio may be calculated for a company using appropriate accounting methods and tools. Taking on debt may be a good idea, but only if done well.

How to Determine After-Tax Debt Cost

If a company gives its financial records to an accountant, the accountant will likely do this task. In spite of this, it is the responsibility of every company owner to determine the true cost of debt after taxes.

1. Create a list of all outstanding debts.

All of a company's interest-bearing obligations must be included here. Whether protected or unprotected, leases, prepaid cards, cash advances, credit lines, and loans backed by real estate are all included. Any company debts that are guaranteed by the owner personally should also be included. Expenses like rent and utilities may be left off this list. Equally irrelevant are labor costs and equity financing, both of which should be included in the overall cost of capital.

2. Determine the corresponding coupon or interest rates for every debt.

Although it is simple to compile a list of outstanding debt, the amount that firms are really paying on their debt is not always crystal evident. Each kind of debt should have its own cost of capital included in this list. That implies a company should track down all of the lease & interest rates it has ever paid. At this stage, it is useful to compile additional debt data for later comparison. Not only should the advantages the loan provides the company be mentioned, but also its length, the cost of any extra fees, the date it will mature, and any other terms. As a result, your future finance options will be more manageable.

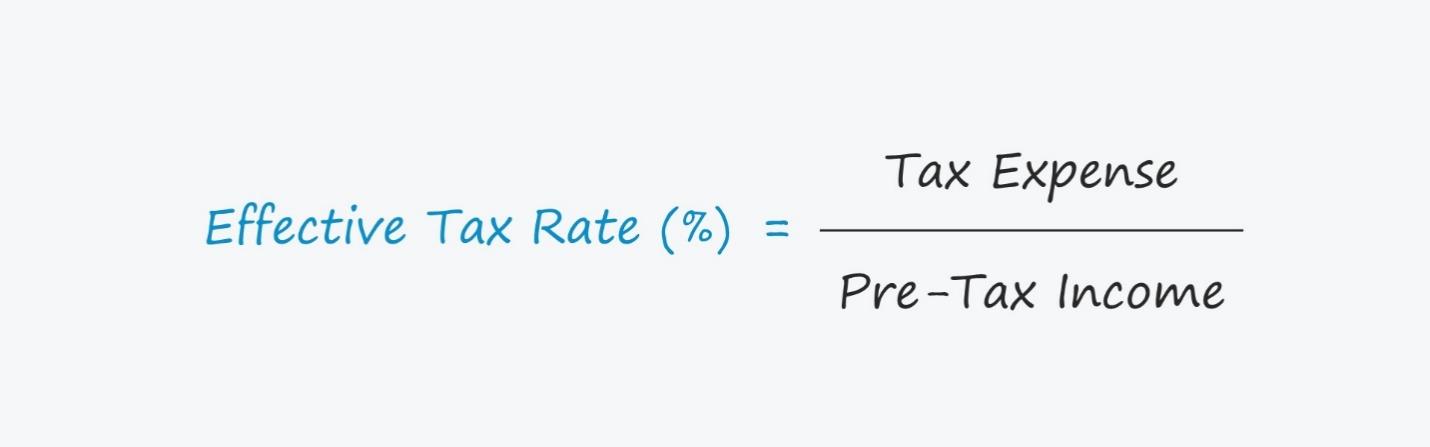

3. Calculate the Business's Effective Tax Rate.

Determining the after-tax cost of debt helps businesses save money in the form of tax deductions for interest paid throughout the year. Therefore, it is essential for firms to determine their effective tax rate in order to calculate their true cost of debt. Identifying a company's effective tax rate is a simple process. After factoring in federal & state tax rates, the effective rate of taxation is used to calculate the after-tax cost of debt for a business. This implies that certain firms may not be subject to either federal or state taxation, depending on where they are located.